About Us

Priority Processing Mortgage Group

Priority Processing Mortgage Group is a third-party, contract processing team to support Loan Originators, Mortgage Brokers and Mortgage Lenders reach their full potential. We help our clients close loans on time, every time. We provide a more efficient, effective loan processing experience than ever before.

With years of experience and our unmatched drive, you can count on us to take care of your clients and relationships. Not only will your borrowers and buyers love working with us but so will your realtors. We know how much time and effort it takes to build your realtor and referral relationships and we are here to solidify those relationships and solidify their trust in you and your ability to provide excellent service to their clients.

Contact

Robert Land, Owner and Senior Loan Processor

Robert@PriorityPMG.com – 386-968-2286

Taylor Tefft, Owner

Taylor@PriorityPMG.com – 386-588-9662

Experience The Difference

Loan Processing Services

Step 1

Review loan file for Underwriting submission to ensure we have a clean loan approval.

Step 2

Order third party documents when required (Title, appraisal, insurance, etc)

Step 3

Communicate with borrower and all parties to obtain all Underwriting conditions in a timely manner.

Step 4

Ensure loans close on time every time

Why would I use Contract loan processing over in-house processing?

Flexibility

Contract loan processing gives the broker or Lender flexibility. If there is an influx of volume, Priority Processing Mortgage Group will be there to help with the additional volume that in house processing cannot handle.

Less Overhead

We are only paid when the loan closes in most instances. If the loan never closes we generally will not be paid a fee. So those months where volume is down, you don’t have the overhead of the processing team salary and benefits.

Generate More Loans

Most mortgage loan officers make the best use of their time, originating loans. Using a contract processing company like Priority Processing Mortgage Group reduces the time spent on tasks related to processing. This means more time is focused on their clients and generating new loans.

Stay Up to Date

Staying up to date with the latest training and processing guidelines can be costly and time consuming for employees. Using our contract loan processing services, will save you from those expenses. We stay up to date with all of the state guidelines and accredited educational programs to ensure our service are top notch.

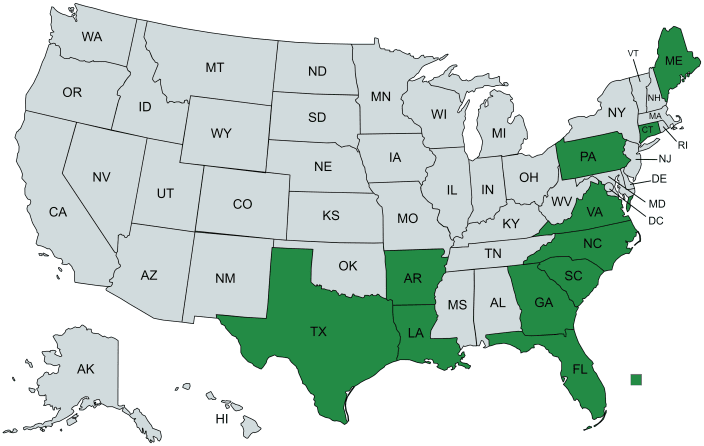

FL, GA, NC, SC, TX, AR, LA, VA, CT, PA and ME